bank owned life insurance regulations

Banks can purchase BOLI policies in connection with employee compensation and benefit plans key person insurance insurance to recover the cost of providing pre- and postretirement employee benefits insurance on borrowers and. The Treasury Department and the IRS recently issued final regulations on reporting requirements and tax obligations for buyers and sellers of life insurance contracts.

Top 10 Pros And Cons Of The Infinite Banking Concept How To Become Your Own Banker In 2022

The bank purchases and owns an insurance policy on an executives life and is the beneficiary.

. Most BOLI programs regardless of contract type selected are designed with a single premium. Included in the regulations is a favorable rule critical for the banking industrya carve-out permitting a company that acquired a corporation that owns life insurance policies in certain transaction. A purchase of life insurance must address a legitimate need of the bank for insurance.

The treasury department and the irs recently issued final regulations on reporting requirements and tax obligations for buyers and sellers of life insurance contracts. The Division of Insurance issues licenses to insurance companies producers and other risk-assuming entities reviews insurance products and rates for compliance with existing regulations and monitors the financial solvency of licensees to ensure product availability in the marketplace. The ability of state chartered banks to purchase life insurance is governed by state law.

Historically the vast majority of BOLI held by community banks is general account Underlying policy assets are held for the benefit of the. If the tax treatment of Bank Owned Life Insurance BOLI changes existing plans may be grandfathered. HOW DOES IT WORK.

The safe and sound use of BOLI depends on effective senior management and board oversight. Bank Owned Life Insurance Rules and Regulations The Interagency Statement on the Purchase and Risk Management of Life Insurance OCC 2004-56 provides general guidance for banks and savings associations regarding supervisory expectations for the purchase and risk management for Bank Owned Life Insurance BOLI. Financial institutions supervised by the Federal Reserve also engage in functionally regulated insurance.

Some banks may not even realize it but maintaining a Bank Owned Life Insurance BOLI policy may have just gotten easier as of late March courtesy of the Internal Revenue Service IRS and the Treasury Department. The interagency statement also provides guidance for split-dollar arrangements and the use of life insurance as security for loans. Purchase and Risk Management of Life Insurance to institutions to help ensure that their risk management processes for bank-owned life insurance BOLI are consistent with safe and sound banking practices.

A life insurance policy you can buy to insure the lives of your key employees. When properly structured in compliance with applicable tax laws and bank regulations a BOLI policy. The insured employees have no.

Bank owned life insurance is a low-maintenance asset that involves. BOLI is a life insurance policy purchased by a bank on the lives of bank employees and is often used to establish an asset on the banks balance sheet to offset its employee benefit liabilities. The guidance attached to this bulletin continues to apply to federal savings associations.

Purchases of life insurance that have been found to be incidental to banking include insurance taken as 1 security for loans 2 insurance on borrowers 3 key-person insurance and 4 insurance purchased in connection with employee compensation and benefit plans. As the policys owner and beneficiary your bank harnesses unique benefits. Specifically on March 22 nd the IRS and Treasury issued proposed regulations related to new.

The financial institution is the premium payer the owner and the beneficiary of the life insurance policies. Bank Owned Life Insurance BOLI is a tax efficient method that offsets employee benefit costs. National banks may purchase and hold certain types of life insurance called bank-owned life insurance BOLI under 12 USC 24 Seventh.

An institutions board of directors must understand the complex risk characteristics of the institutions insurance holdings and the role this asset. Universal life and traditional. Bank-Owned Life Insurance Life insurance is regulated primarily by the states.

Under most state laws there are two regulatory regimes for permanent including BOLI contracts. Life insurance with an aggregate cash surrender value CSV in excess of 25 percent of capital even though the agencies have previously identified this capital concentration threshold as the level that institutions should consider when establishing internal limits for their BOLI holdings. A financial institution purchases life insurance on a select group of key employees.

This tax-advantaged asset acts similarly to a bond allowing banks to offset the expenses needed for superior benefits andor informally fund executive benefits. It should be noted that BOLIs current tax benefits have been unsuccessfully challenged over the years. The regulations governing bank owned life insurance boli depend on the structure of the financial institution.

What is Bank-Owned Life Insurance BOLI. But if they are not grandfathered they may be surrendered for their cash surrender values. BOLI and other forms of life insurance investments provide tax-exempt income if the policy is held until the.

Banking organization insurance programs include the funding of employee benefits through purchases of corporate- or bank-owned life insurance and the transfer of insurable risks through coverages associated with risk management initiatives. Owned and invested by the life insurance company and are part of the carriers general assets. The Office of the Comptroller of the Currency the Board of Governors of the Federal Reserve System the Federal Deposit Insurance Corporation and the Office of Thrift Supervision have issued the attached interagency statement on bank-owned life insurance BOLI to.

Cash surrender values grow tax-deferred providing the bank with monthly bookable income. Bank Owned Life Insurance and Tax Reform. Product pricing and description follow the general rules governing life insurance.

A form of permanent life insurance owned by banks to offset the future costs of. Bank-owned life insurance is a type of life insurance bought by banks as a tax shelter leveraging tax-free savings provisions to fund employee benefits. BOLI or bank-owned life insurance is just what it sounds like.

Of the many tax law changes enacted as part of the Tax Cuts and Jobs Act of 2017 TCJA one provision is raising concern among banks involved in certain post-2017 acquisitions of target banks with ownership in bank-owned life insurance BOLI policies. Long Awaited BOLI Clarification.

Federal Register Regulatory Capital Rules Risk Based Capital Requirements For Depository Institution Holding Companies Significantly Engaged In Insurance Activities

Is Life Insurance Taxable Forbes Advisor

/GettyImages-539244461-88be1a7f24a049229ce2956e0a60d393.jpg)

Corporate Ownership Of Life Insurance Coli Definition

Common Mistakes In Life Insurance Arrangements

Bank Safety And Soundness Regulatory Service Lexisnexis Store

Why Are Businesses Purchasing Life Insurance On Their Employees West Sound Workforce

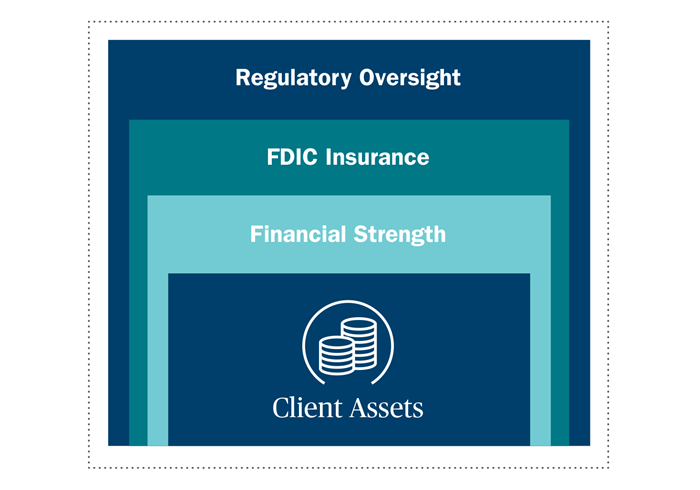

Understanding Sipc And Fdic Coverage Ameriprise Financial

5 Tips For Selling Your Life Insurance Bankrate

Key Factors Nris Should Consider Before Buying A Life Insurance Policy

Understanding Sipc And Fdic Coverage Ameriprise Financial

Common Mistakes In Life Insurance Arrangements

Bank Owned Life Insurance Boli

/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank Owned Life Insurance Boli

Federal Register Regulatory Capital Rules Risk Based Capital Requirements For Depository Institution Holding Companies Significantly Engaged In Insurance Activities

Unwinding An Irrevocable Life Insurance Trust That S No Longer Needed

Federal Register Regulatory Capital Rules Risk Based Capital Requirements For Depository Institution Holding Companies Significantly Engaged In Insurance Activities

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)